Administration, translation and tax returns

FMZ can support you with administrative assignments

FMZ can support you with administrative assignments

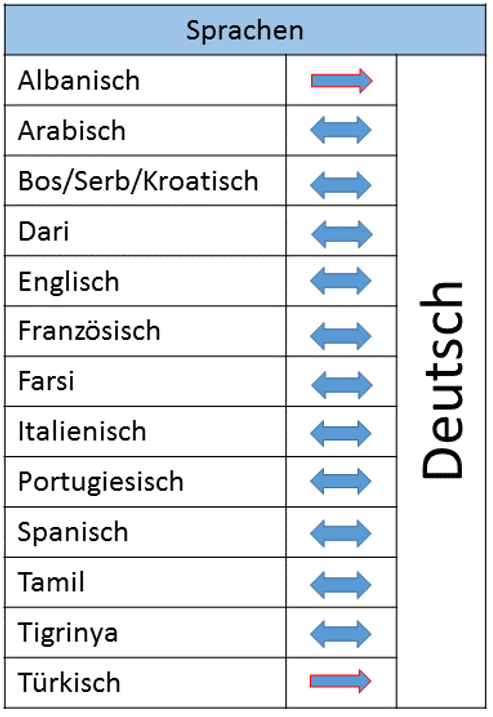

We offer the following services:

For smaller tasks (5 - 10 minutes) please visit the Welcome Desk during opening hours.

For more complex requests, such as translation work or tax returns, please arrange an appointment with a consultant.

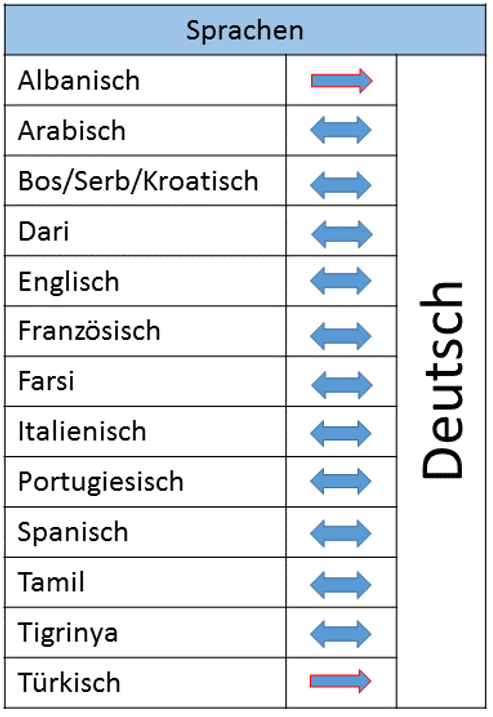

We reserve the right to only accept translation work when we have the capacity.

If we are unable to accept an assignment, we can provide a list of alternative translation agencies in canton Zug.

A cost estimate will be provided upon submission of a copy of the document to be translated. The translation assignment will begin only after advance payment of the agreed cost (calculation basis: CHF 2.50 - CHF 3.- / 55 characters, including spaces - depending on the language and complexity of the original text)

The minimum fee for a translation is CHF 40.- .

The normal lead time for translation work is 2 weeks (minimum).

The municipal notary offices, the office of the State Chancellery and independent lawyers are able to issue notarisations for Switzerland and abroad.

Certified FMZ translations are accepted in the canton of Zug. Additional certification is sometimes required for other countries. We charge a fee of CHF 60.- to obtain this apostille from the State Chancellery.

Gebühren

An individual cost estimate will be provided upon receipt of the document to be translated.

Assignments will begin only upon receipt of payment

CHF 100.- per hour / minimum fee of CHF 40.-

Express surcharge required for urgent assignments:

3-5 working days: CHF 40 / 1-2 working days: CHF 80.-

Our employees can also provide written work as required by the consultation. This work will be charged additionally according to time and complexity.

Fees

Completion of forms

minimum CHF 20.- according to time and complexity

Simple letters (terminations, inquiries, etc.)

minimum CHF 20.- according to time and complexity

Complex letters (payment requests or similar)

mindestens CHF 40.- je nach Aufwand

Written appeals or similar

minimum CHF 75.- according to time and complexity. Calculation basis: CHF 100.- / per hour

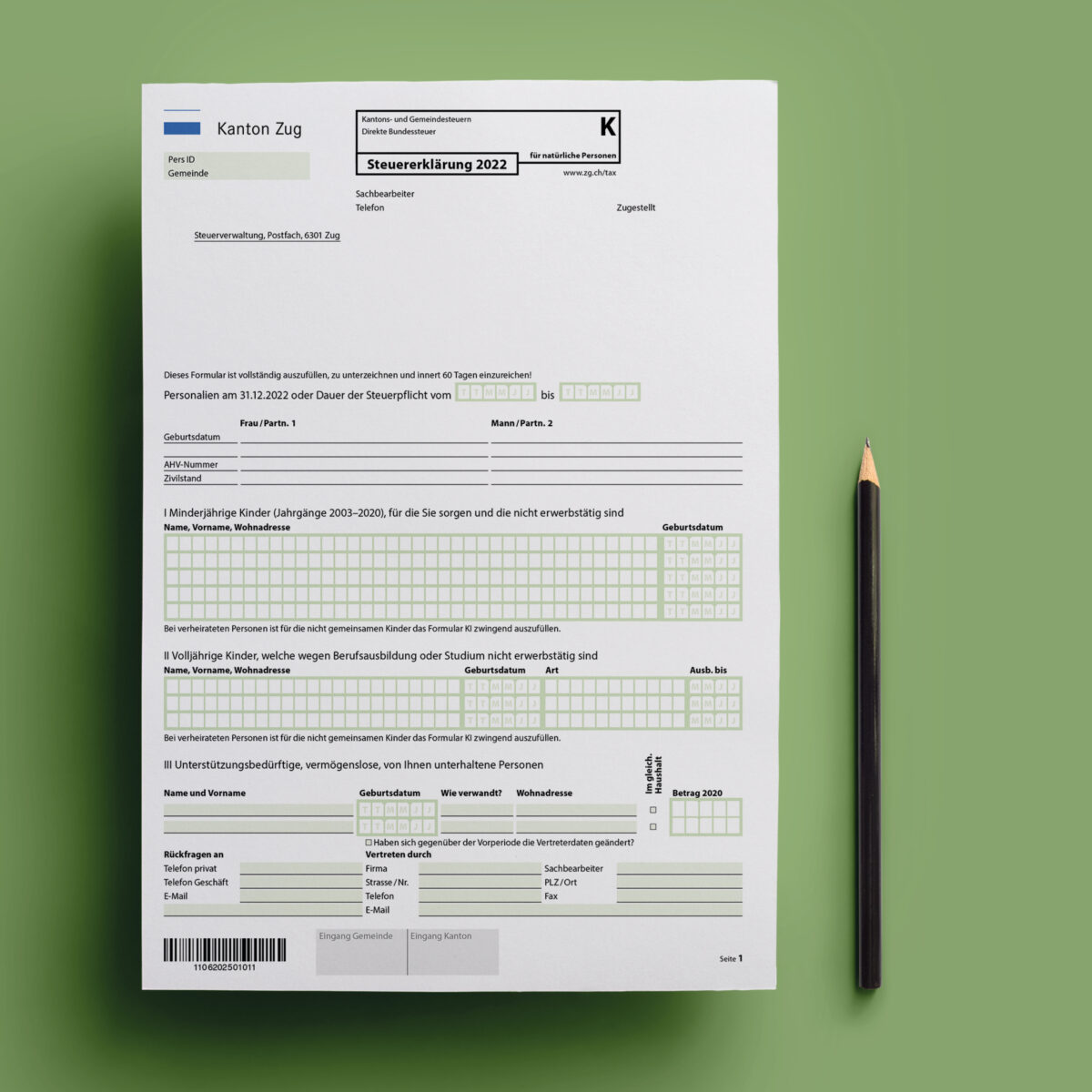

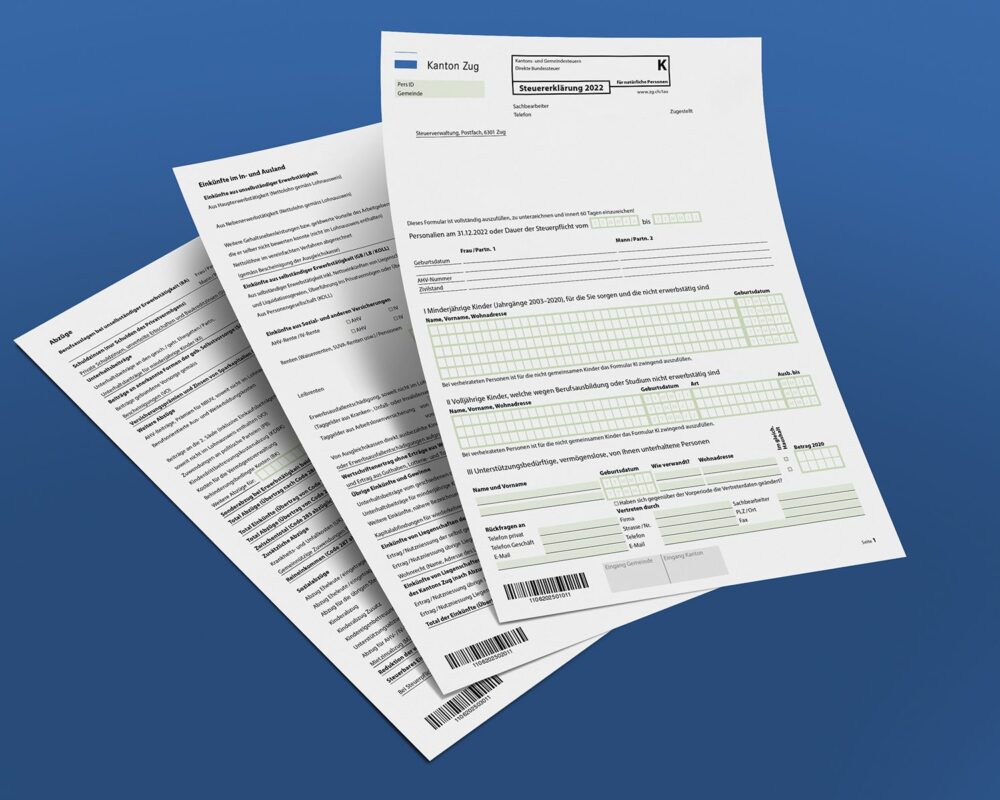

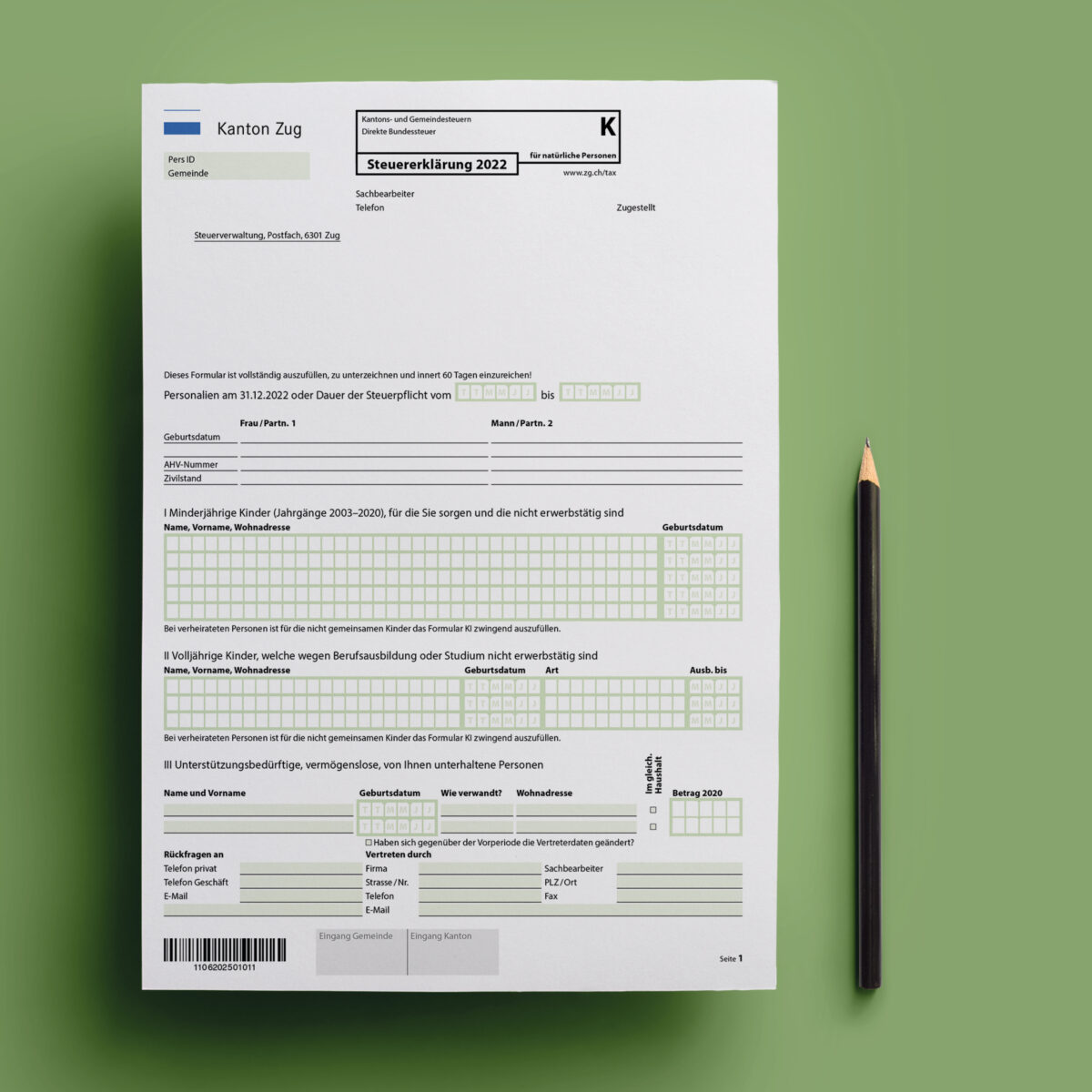

Individual (Max income CHF 100`000)

up to CHF 80'000.-

from CHF 80'001.- to 100`000

Pensioner

EL Supplementary Benefits recipient

Social support recipient (no income / employed)

Student

CHF 90.-

CHF 110.-

CHF 60.-

CHF 50.-

CHF 10.- / 50.-

CHF 50.-

Married / Family (Max income CHF 120`000)

up to CHF 80'000.-

from CHF 80'001.- to 100`000

CHF 100`001 to CHF 120`000

Pensioner

EL Supplementary Benefits recipients

Social support recipients (no income / employed)

CHF 110.-

CHF 130.-

CHF 150.-

CHF 90.-

CHF 60.-

CHF 10.- / CHF 60.-

Extras (if required) :

More than 4 bank accounts - each additional account +CHF 5.-

Postage: CHF 5.- (or collect at no charge)

Express surcharge for completion within 2 weeks: CHF 50.-

FMZ accepts no liability for incorrect, incomplete, or misleading information provided by clients.

- Your bank

- Zuger Treuhandvereinigung Tel + 41 41 712 13 12 or www.ztv-zug.ch

We reserve the right to only accept translation work when we have the capacity.

If we are unable to accept an assignment, we can provide a list of alternative translation agencies in canton Zug.

A cost estimate will be provided upon submission of a copy of the document to be translated. The translation assignment will begin only after advance payment of the agreed cost (calculation basis: CHF 2.50 - CHF 3.- / 55 characters, including spaces - depending on the language and complexity of the original text)

The minimum fee for a translation is CHF 40.- .

The normal lead time for translation work is 2 weeks (minimum).

The municipal notary offices, the office of the State Chancellery and independent lawyers are able to issue notarisations for Switzerland and abroad.

Certified FMZ translations are accepted in the canton of Zug. Additional certification is sometimes required for other countries. We charge a fee of CHF 60.- to obtain this apostille from the State Chancellery.

Gebühren

An individual cost estimate will be provided upon receipt of the document to be translated.

Assignments will begin only upon receipt of payment

CHF 100.- per hour / minimum fee of CHF 40.-

Express surcharge required for urgent assignments:

3-5 working days: CHF 40 / 1-2 working days: CHF 80.-

Our employees can also provide written work as required by the consultation. This work will be charged additionally according to time and complexity.

Fees

Completion of forms

minimum CHF 20.- according to time and complexity

Simple letters (terminations, inquiries, etc.)

minimum CHF 20.- according to time and complexity

Complex letters (payment requests or similar)

mindestens CHF 40.- je nach Aufwand

Written appeals or similar

minimum CHF 75.- according to time and complexity. Calculation basis: CHF 100.- / per hour

Individual (Max income CHF 100`000)

up to CHF 80'000.-

from CHF 80'001.- to 100`000

Pensioner

EL Supplementary Benefits recipient

Social support recipient (no income / employed)

Student

CHF 90.-

CHF 110.-

CHF 60.-

CHF 50.-

CHF 10.- / 50.-

CHF 50.-

Married / Family (Max income CHF 120`000)

up to CHF 80'000.-

from CHF 80'001.- to 100`000

CHF 100`001 to CHF 120`000

Pensioner

EL Supplementary Benefits recipients

Social support recipients (no income / employed)

CHF 110.-

CHF 130.-

CHF 150.-

CHF 90.-

CHF 60.-

CHF 10.- / CHF 60.-

Extras (if required) :

More than 4 bank accounts - each additional account +CHF 5.-

Postage: CHF 5.- (or collect at no charge)

Express surcharge for completion within 2 weeks: CHF 50.-

FMZ accepts no liability for incorrect, incomplete, or misleading information provided by clients.

- Your bank

- Zuger Treuhandvereinigung Tel + 41 41 712 13 12 or www.ztv-zug.ch